Dual citizenship: pros and cons of having two and more passports

The advantages and disadvantages of holding dual citizenship, together with two or more passports

A person who has citizenship in more than one country enjoys a variety of advantages, including increased freedom of movement, access to the most cutting-edge medical treatment available, and access to a broader range of educational possibilities. Having two passports does come with a few drawbacks too, so keep that in mind.

What exactly is meant by the term “dual citizenship,” and how does it contrast with “second citizenship”?

The concepts of dual citizenship and second citizenship are not synonymous with one another. Having passports from two separate countries is a need for each of these options, but the requirements are different for each one.

Being a citizen of two nations that share a citizenship agreement with one another is what is meant by the term “dual citizenship.” The rights and responsibilities associated with holding dual citizenship are acknowledged by both parties to the aforementioned agreement.

People who have dual citizenship are required to pay taxes and serve in the armed forces of their primary country of residence. They are shielded from being subject to taxes twice.

Having second citizenship requires you to carry passports from two nations that do not share any reciprocal arrangements about citizenship. In this scenario, each nation grants its inhabitants the ability to possess passports from other nations, but it does not recognize the individuals’ rights or duties in connection to other states.

Someone who has two passports can be required to pay taxes in each of those nations.

With a passport from a third nation, am I able to enter the United States or the European Union?

You can’t do it at all. However, this is something that is doable after acquiring a second residence permit or citizenship. If you subscribe to our newsletter, you will get genuine industry information before anybody else.

The advantages of possessing dual citizenship or a second country’s citizenship

The bulk of the advantages that come with having dual citizenship are the same as those that come with having single citizenship; nevertheless, having dual citizenship does provide its possessor greater flexibility in terms of taxes and other duties.

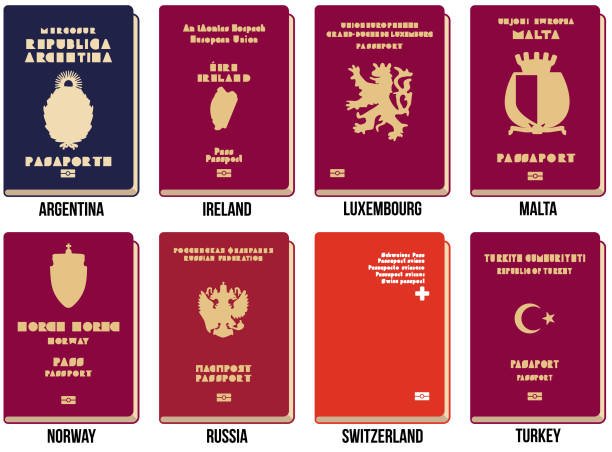

Travel opportunities. A person who has citizenship in more than one country may use either of their passports to go to the country of their choice with fewer or no visa requirements.

A citizen of Algeria who also has a passport from Portugal, for instance, is able to visit the Schengen nations without having to deal with the inconvenience of obtaining a visa by using their Portuguese passport.

When planning a trip to the United States, Portuguese citizens do not need to go through the difficult process of applying for a visa since they are eligible for an electronic travel authorization that can be obtained in as little as half an hour.

Business possibilities.

The ability to have dual or even second citizenship gives individuals the flexibility to establish a company in whatever nation provides the most favorable conditions.

Conditions that are favorable to business might include things like an economy that is stable, a taxation structure that is favorable, government backing for new businesses, the proportion of workers who have higher education, etc. The United Arab Emirates (UAE), Denmark, Germany, Australia, and Canada are ranked as the top six nations in which to do business by the publication Ceoworld Magazine.

Rights in political matters Citizens of a nation are entitled to the entire range of political rights available to them, regardless of whatever passports they may possess from other countries. Individuals who possess citizenship in more than one state are eligible to vote and participate in the civil and political life of each of those states. They are free to go to and reside in their nation of citizenship at any time, without being subject to any restrictions.

People who have dual or multiple citizenship have the ability to work and own property in each of their countries, in addition to receiving social benefits.

Possibility of selecting a more suitable healthcare system. A person who has dual citizenship has the option of seeking medical treatment in either of their countries of origin, whichever has the superior healthcare system.

For instance, a person who is a citizen of the United States but also has a passport from Malta is eligible to get free medical care in Malta and does not need to pay for health insurance in the United States.

More opportunities for educational pursuits. The possessor of a second passport and their children are able to choose the nation of their choice for education and attend colleges inside that nation without having to pay the additional tuition expenses.

In some circumstances, obtaining second citizenship might open doors to possibilities not only in one country but in numerous. For example, a citizen of one EU state may attend any university in any other EU state without having to pay the higher tuition rate that applies to international students.

The possibility of reducing the amount of burden caused by taxes. In many situations, holding several citizenships gives the possessor the opportunity to reduce the amount of taxes they are required to pay. The individual is free to choose the nation that offers a taxation system that is to their advantage before becoming a tax resident there.

Some nations do not require their residents to pay income taxes, while others do not tax income gained outside the country, income on wealth, inheritance, or gift, and some still do not tax income obtained via charitable donations. Antigua and Barbuda, the United Arab Emirates, and Vanuatu are some examples of nations that provide its residents the opportunity to minimize their tax burden.

A person who has several citizenships is required to become a tax resident of one of the countries after evaluating their alternatives and selecting the state that offers the greatest financial advantage in terms of taxes. In most cases, you will be required to have a residence there for at least six months out of each year.

The drawbacks of having second citizenship or holding dual citizenship

Having several citizenships comes with its share of responsibilities as well as benefits. The majority of them are only possibilities and are not certain to occur.

There is a possibility of double taxation.

The possibility of paying taxes twice for those who have dual citizenship is counterbalanced by the possibility of paying lower taxes. This possibility exists for both international income tax and international property tax, depending on the country and its legislation.

Excepted from some professional tracks.

Dual citizenship may be problematic for a number of reasons, one of which is that in certain nations, its holders are barred from working in government agencies and are denied the ability to hold positions such as that of a judge, minister, or deputy.

The requirement of military service.

A person who has several citizenship runs the risk of having their other passports revoked if they serve in the armed forces of any one of their states. On the other hand, this occurs only extremely seldom and is subject to the regulations of the individual state in question.

How to get a second citizenship or dual citizenship

Every nation has its own set of requirements that must be met before a foreign individual may become a citizen. In most cases, each method can be broken down into one of these three categories: inheritance, naturalization, or financial investment.

Investment.

Programs that provide citizenship in exchange for financial investment are available in a number of nations. The applicants are obliged to make an investment in the economy of the nation, which may take the form of a payment to a government fund, the acquisition of real estate, or the funding of a company. After that, investors are eligible for citizenship in the United States.

The procedure typically takes between six and eight months to complete. The applicant may include their spouse and children in the application and be required to supply passports for them as well.

The investor does not need to demonstrate any links to the country in order to get citizenship, nor is it necessary for them to learn the native language. The primary qualifications for potential investors often consist of having a minimum age of 18 years old and demonstrating that all of their income is legitimate.